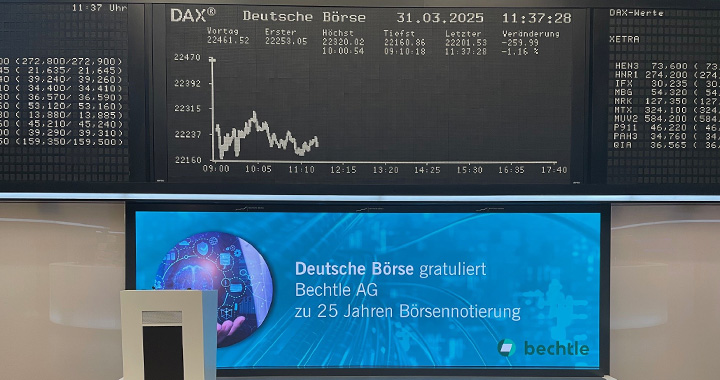

25 years since the IPO – A launchpad for Bechtle’s success story.

On 30 March 2000, the bell rang in Bechtle’s stock market debut. Thousands of trading days later, we look back at the highlights of its journey.

Written by

Back in time.

In 1988, Bechtle formulated its very first vision, headlined “We have a dream“. The goal was to go public in the year 2000, with a revenue of 100 million Deutschmarks. At the time, Germany’s Neuer Markt segment for tech-driven companies didn't exist yet, nor was there anything resembling today's hype surrounding IPOs. Going public was simply seen as a good way for a company to become financially independent of individual stakeholders, and that was also the rationale at Bechtle—reduce the founding families’ shareholdings and raise capital to safeguard the company’s long-term future.

Eleven years later, on 19 May 1999, a closed-door strategy meeting took place in the small town of Oberstenfeld, a half hour’s drive away from the company's first offices in Heilbronn. A small group of seven participants gathered, with the session chaired by Kurt Dobitsch—then a member of the Bechtle Advisory Board, now on the Supervisory Board. Top of the agenda: Was Bechtle ready to go public? After nearly ten hours of intense discussion, the meeting minutes concluded: “The unanimous opinion is that Bechtle is in an excellent position for a successful IPO.”

Three questions for Bechtle co-founder, Ralf Klenk.

Mr Klenk, is there a particular moment from 30 March 2000 that stands out in your memory?

The ringing of the stock exchange bell was a very emotional moment. The sound went straight from the ears to the heart—it was truly one of a kind. What also stood out were the many interviews with TV and the print media. That was a completely new experience for me, and I suddenly realised: Bechtle matters! We’d made it, we were playing in the big leagues now.

Hand on heart: was there ever a moment in the run up to the IPO when you had doubts about the timing?

Never! But that was down to the fact we had a dynamic duo at the top, with clearly defined roles. Gerhard Schick was responsible for the financial side, while I took care of operations. So the main burden—apart from the roadshows—fell to Gerhard, and I always knew he’d make it work. I never doubted Bechtle or our success. “Can’t be done” just wasn’t in our vocabulary. That’s how it was.

In what ways did Bechtle benefit most from the IPO in the years that followed?

First and foremost, it has allowed us to realise our acquisition strategy and found new subsidiaries. Without the IPO, we would never have been able to grow at the rate we have. We made a promise to use our shareholders’ money wisely and invest in the future of Bechtle—and that’s exactly what we did.

Ralf Klenk

Dr Thomas Olemotz

Three questions for Dr Thomas Olemotz, CEO, Bechtle AG.

Dr Olemotz, Bechtle has acquired 119 companies to date. Would that have been possible without being listed on the stock exchange?

Certainly not in the early years. According to my predecessors, one of the key motivations for going public was to secure the financial means to continue the acquisition strategy that began in 1993. Another reason was to reduce dependency on the capital of the founding families—and not least, to safeguard the company against potential takeovers.

What issues are currently dominating the capital market?

In the short term, economic developments are the dominant theme. In the longer term, it’s the structural changes in our industry that may impact our business model. I see it as a huge advantage to be active in an industry whose future viability is not in question—combined with a unique business model and the financial strength that open the door to further organic and inorganic growth.

What came first for you, holding Bechtle shares or your employment contract?

My employment contract. Bechtle’s IPO came at an absolutely wild time. Before joining Bechtle, I had already served on the executive board of a company listed on the Neuer Markt, but with the huge number of IPOs happening at the time, it was simply impossible to keep track or really understand the individual stocks, which is unthinkable today.

IPO.

Looking back, the timing proved almost perfect. Bechtle goes public just days after the NEMAX—an index tracking the most important stocks on Germany’s Neuer Markt—reached its all-time high on 10 March 2000. On 30 March, the issue price is set at 27 euros, and trading opens at 30 euros under Bechtle’s ticker symbol, BC8. Investor demand far outstrips supply—the share is twelve times oversubscribed, and five million are issued. The capital raised would secure the further expansion of the Bechtle Group. In the same fiscal year, and with over 30 locations and 1,680 employees, the company generates revenues totalling some 956 million Deutschmarks.

- IPO: 30 March 2000

- Issue price: 27 euros

- Opening price: 30 euros

- Ticker symbol: BC8

(From left to right) Uli Drautz, Head of Corporate Controlling; Ralf Klenk, Bechtle Co-founder; Stefan Sagowski, Executive Vice President – Finance.

The IPO was a milestone in the Bechtle story and it came at exactly the right time. This was the day on which the perception and size of the company as well as our financial resilience changed significantly.

Uli Drautz, Head of Group Controlling, Bechtle AG

We all knew the stakes—we’d either go public on 30 March or not at all. Timing was absolutely critical as it was becoming apparent that the Neuer Markt bubble was about to burst.

Stefan Sagowski, Executive Vice President for Finances, Bechtle AG

Facts and figures.

Holding 35.02%, the Schick family has been the anchor shareholder from day one. To honour the life and achievements of Bechtle co-founder Gerhard Schick, who recently passed away, the family’s shares are to be transferred to a charitable foundation, securing them for future generations. Speaking of continuity, in the 25 years since the IPO, Bechtle has been led by only three different CEOs—Gerhard Schick, Ralf Klenk and Dr Thomas Olemotz.

- The Schick family’s stake in share capital: 35.02%

In 2000, only a handful of companies on the Neuer Markt turn a profit and are able to pay out a dividend. With a proposed dividend of 0.25 euros per share, Bechtle is one of the few exceptions. Since going public, Bechtle’s dividend policy has been favourable to shareholders and focused on continuity—paying out profits every year without fail, and the dividend has never been reduced. For the 2024 fiscal year, the proposed payout ratio is 35.9%—subject to AGM approval—translating into a total distribution of 88.2 million euros, or 0.70 euros per share.

- Dividend in 2000 (IPO year): 0.25 euros

- Dividend in 2024: 0.70 euros (2025 AGM proposal)

By the end of 2000, Bechtle’s market capitalisation stands at 181.6 million euros. After many years of growth, it peaks at over 8.7 billion euros on 9 November 2021, and the share hits an all-time high of 69.14 euros (XETRA closing price, adjusted for splits). In the years that follow, the share cannot fully escape the pressures of the broader economic climate. Today, market capitalisation stands at around 4.5 billion euros.

- Market cap at IPO: €181.6 million

- Current market cap: Approx. €4.5 billion

- All-time-high share price: €69.14

Following the IPO, Bechtle’s share capital totalled 21 million euros, divided into 21 million no-par value shares. In 2017, share capital doubled to 42 million euros and Bechtle AG shareholders received one additional share for each one they already held. Then in 2021, a further capital increase was realised from company reserves. The share was split 3-for-1, which saw share capital triple to 126 million euros.

- First stock split: 2017 (2 for 1)

- Second stock split: 2021 (3 for 1)

- Current share capital: 126 million euros

- 19 analyst firms cover the share

With the share price soaring by 61.3% in 2004, in September of that year, the Bechtle share moved from the still-existing NEMAX 50 to the TecDAX, which tracks the 30 largest and most liquid tech stocks in Germany's Prime Standard below the DAX. When Deutsche Börse abolished the distinction of Tech and Classic segments in September 2018, Bechtle was additionally listed in the MDAX, which covers the 50 largest listed companies below the DAX. Since then, Bechtle has consistently ranked among the 90 largest listed companies in Germany.

The share is also listed in the DAXplus Family 30 index (covering the 30 largest and most liquid family-owned companies) and, since 24 March 2025, also in the DAX 50 ESG index, representing the 50 largest, most liquid German stocks with strong ESG scores—covering environmental, social and governance criteria—excluding companies involved in controversial activities like weapons, tobacco, nuclear power, thermal coal or armaments.

Bechtle is covered by four indices:

- MDAX

- TecDAX

- DAX 50 ESG

- DAXplus Family 30

At the end of 2023, Bechtle successfully invests in convertible bonds with a nominal value of 300 million euros and a term of seven years. These bonds are heavily oversubscribed. The aim is to invest in future-oriented business segments such as artificial intelligence and in acquisitions both within Germany and internationally. Since its founding, Bechtle has acquired 119 companies, cementing its market position across 14 countries. Previously, Bechtle had financed acquisitions through conventional loan agreements, but given the high interest rates at the time, convertible bonds are the more attractive option.

- Total nominal value of the convertible bonds: 300 million euros