The government will give you up to 30% a year for free!

Investing in IT is now doubly worthwhile, because – quite apart from the benefits of state-of-the-art systems – the state will also give you some of your money back. July 2025 saw the launch of the investment booster, which the German federal government hopes will inject fresh momentum into the economy. The scheme enables your company to record depreciation on a declining-balance basis worth up to 30% on certain purchases We explain below how your business will benefit.

Feel free to check in with us to learn how you can use the investment booster to invest in your IT while reducing your tax bill.

The added value for your company.

With the investment booster, the federal government is supporting your investments. It is definitely worth it, because your company will be able to record much higher depreciation than previously on purchases made until 31 December 2027. This gives you:

A smaller tax bill.

More cash spare for new projects.

Faster access to cutting-edge IT.

Find out everything you need to know about the investment booster in our explanatory video (only available in German):

We use YouTube to embed video content on our website. This service may collect data on your activity. For more information, please go to the settings page.

Which areas of IT will benefit specifically?

You will derive particular benefit when purchasing assets that would usually have to be depreciated over four or more years according to the relevant AfA table (“Absetzung zur Abnutzung”, or “depreciation for wear and tear”) published by the German Federal Ministry of Finance. These include:

-

Enterprise server systems

-

Storage arrays and SANs

-

Backup infrastructure → now 30% instead of 14% in Year 1!

-

ERP systems (SAP, Dynamics)

-

CAD, CAM, PDM software (SOLIDWORKS, SolidCAM)

-

CRM platforms

-

BI solutions → now 30% instead of 20% in Year 1!

-

Core switches and routers

-

Firewall systems

-

WLAN controllers → much shorter depreciation periods now possible.

-

Telephone systems (on-premise)

-

Contact centres

-

Video conferencing systems → Large-scale investments now more attractive.

Benefit from the latest equipment and more cash to play with!

The investment booster will hone your competitive edge by giving you access to the latest hardware and software and leaving you much more cash to spare. This will make your CFO happy and undoubtedly speed up the internal approval process for planned IT investments. Follow this rule of thumb to calculate how much spare cash you can now expect:

Long period of depreciation for wear and tear (7 years): Investment × 10% = cash benefit in Year 1

Moderate period of depreciation for wear and tear (5 years): Investment × 6% = cash benefit in Year 1

Example: €500,000 for servers = around €50,000 extra spare cash!

Be careful, though, as the booster only applies to purchases made before 31 December 2027. You should therefore act now and make the most of your cash benefit.

Webinar on the investment booster – watch now!

In our webinar recording on the investment booster, you will learn, among other things, who can particularly benefit from this funding and how you can apply for it. Watch now and reap the rewards!

Webinar on the investment booster – watch now!

In our webinar recording on the investment booster, you will learn, among other things, who can particularly benefit from this funding and how you can apply for it. Watch now and reap the rewards!

Case study shows the investment booster at work.

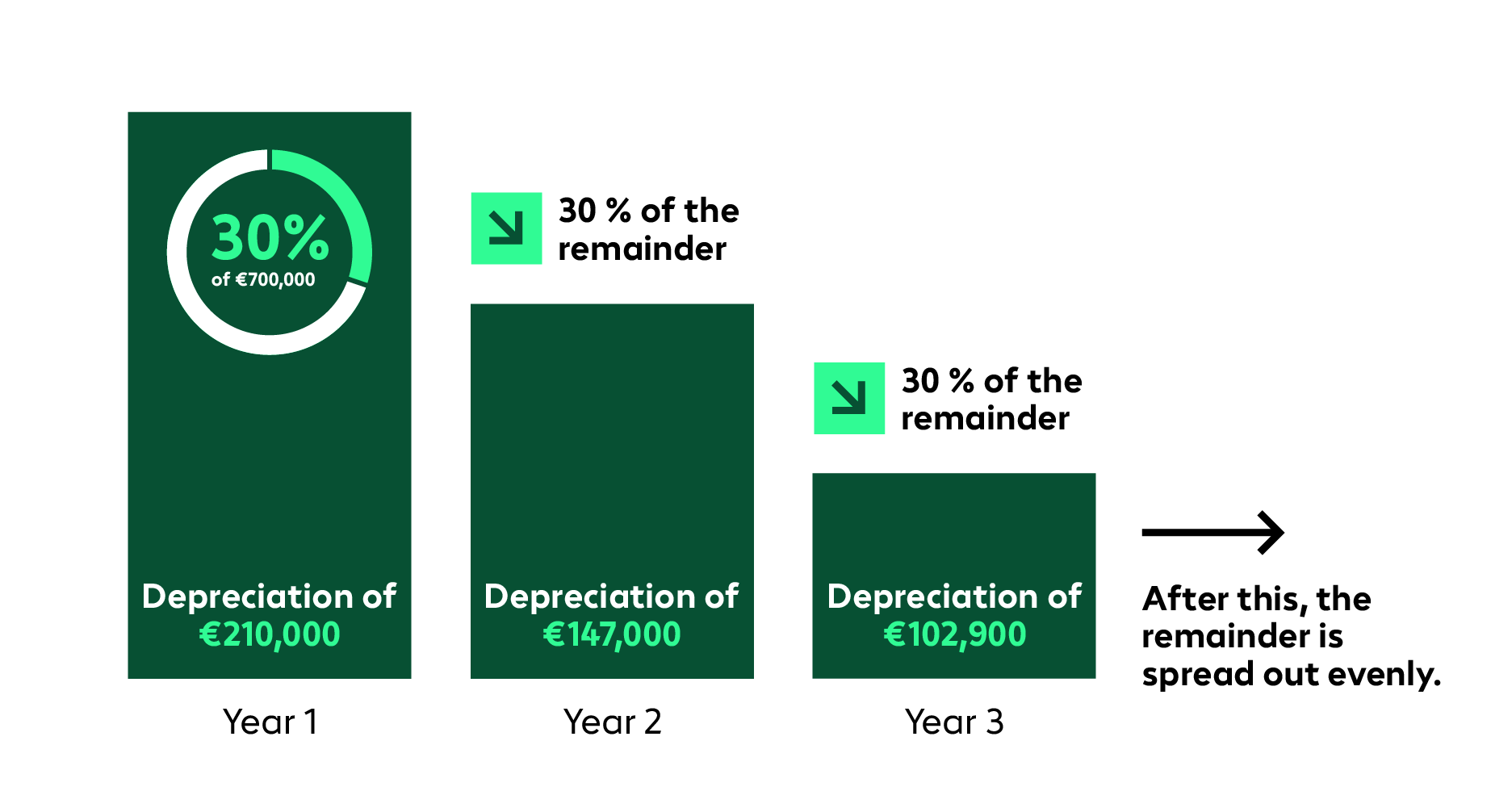

A fast-growing provider of cloud services wants to expand its in-house data centre so orders servers worth €700,000. The depreciation recorded for the investment breaks down as follows over the first three years:

The end result is that 65% of the investment has been depreciated after just three years. The remainder can be spread across the residual useful life of the investment in subsequent years and depreciated on a straight-line basis.

N.B.: your tax advisor can tell you about the investment and depreciation options that will be suitable for you.

Investments that pay off: discover our portfolio.

In this section, you will find selected white papers and webinar recordings relating to our portfolio. Find out how we can work together to develop and protect your IT and make it fit for the future.

The investment booster in a nutshell.

The investment booster is a federal government programme to support the economy. It allows companies to reduce their tax bill by giving them the option to record depreciation at up to 30% on purchases over a period of three years. There is no minimum investment limit – you will start saving from the very first euro you spend. Make the most of the investment booster to modernise your IT systems! Contact us right away for a no-obligation consultation.

FAQs about the investment booster.

A temporary subsidy program from the German federal government that offers companies attractive tax conditions. This allows them to write off significantly more than before on investments in the first three years, thereby increasing their liquidity. The Investment Booster has been in effect since July 2025 and will remain in force until December 31, 2027.

The Investment Booster is particularly worthwhile for larger IT projects (e.g., data center expansion, purchase of a new ERP system, network modernization, etc.). The tax advantages and higher liquidity are strong arguments for finance departments and management to release budgets for IT investments now.

Important to know: The investment booster only applies to movable fixed assets (e.g., machinery, equipment, or vehicles) and not to real estate or intangible assets.

This is a declining balance depreciation method that allows you to depreciate up to 30 percent of the acquisition costs in the first year, which is approximately three times the amount of a straight-line depreciation. After that, you can continue to depreciate up to 30 percent of the residual book value each year until the end of 2027, before the depreciation finally transitions to straight-line depreciation. Incidentally, there is no minimum investment amount – the investment booster applies from the very first euro.

Because an investment can no longer be depreciated linearly over many years, but rather on a declining balance basis, this results in tax advantages for companies. In the first three years, they can depreciate higher amounts, which improves liquidity during this period and increases financial flexibility.

You can use the investment booster to modernize existing IT infrastructures. However, you only benefit from the tax advantages for newly purchased movable assets. This means you can only apply the investment booster to IT systems (e.g., servers, storage arrays, business software, network infrastructure, etc.) that you purchase new.

Bechtle offers you a wide range of IT equipment for which the investment booster will now let you record depreciation over a short period. If you get in touch with us today, we will be happy to advise you and calculate just how much you yourself could save.

* Mandatory field.

If you’d like to know more about how we handle your personal data, please read our Privacy Policy.