All about the Bechtle Share.

We use EQS Infront GmbH to embed content on our website. This service may collect data on your activity. For more information, please go to the settings page.

Performance YTD at 30/1/2026

Market cap as of 30/1/2026

All-time high at 9/11/2021

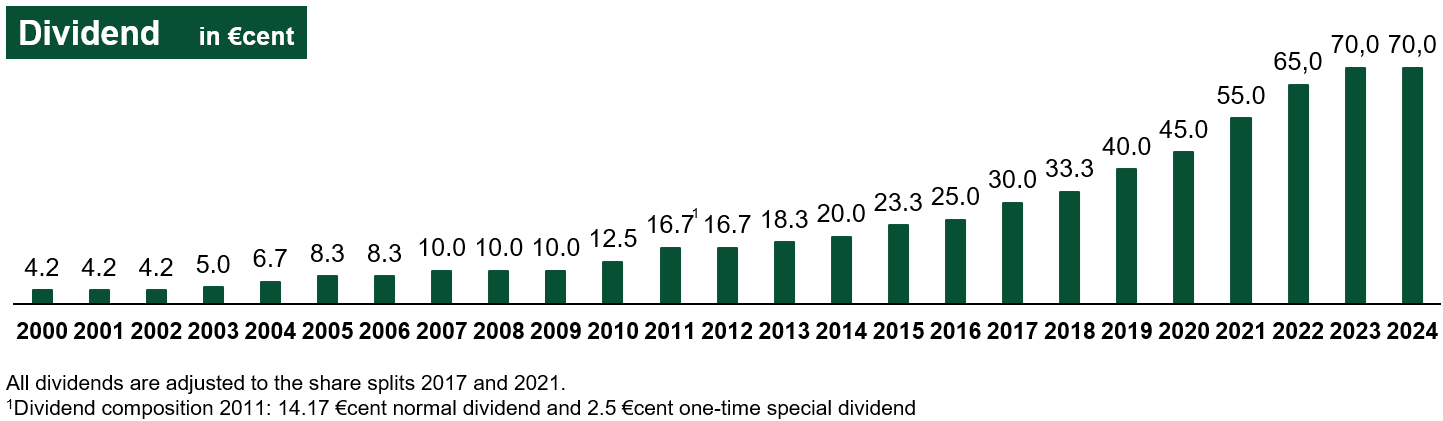

Since its IPO in 2000, Bechtle has pursued a shareholder-friendly dividend policy focused on continuity. Year after year, the company has thus distributed profits to its shareholders. What is more, the dividend is regularly increased. So far, Bechtle has never reversed this trend. This too underscores the reliability of the distribution policy of Bechtle AG.

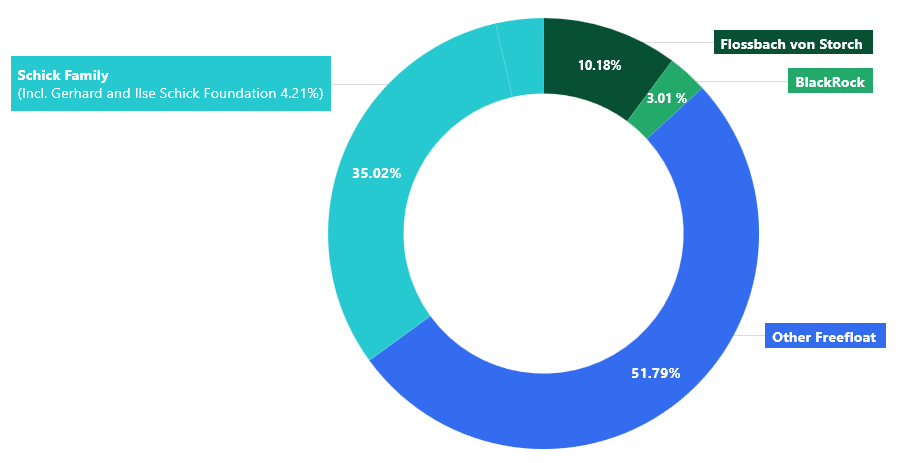

The presentation of the share ownership is based on the provisions of § 33 (1) WpHG with respect to the publication of the voting rights announcements.

As of January 2026, 126 million shares

All voting rights announcements are available on EQS News.

|

Shareholder

|

Release Date

|

|

|---|---|---|

| Karin Schick | 2/5/2022 | Learn More |

| Allianz Global Investors | 18/11/2025 | Learn More |

| DWS Investment | 18/3/2024 | Learn More |

| BlackRock | 5/2/2026 | Learn More |

| Flossbach von Storch |

23/7/2024 24/7/2024 |

13 x Buy, Outperform, Add or Overweight

2 x Hold or Neutral

1 x Underperform

Average price traget of €45.16

|

Institute

|

Date

|

Rating

|

Price target (EUR)

|

|

Baader Bank/AlphaValue |

6/2/2026 |

Add |

47.40 |

|

Berenberg |

2/2/2026 |

Hold |

38.00 |

|

BNP Paribas Exane |

11/2/2026 |

Outperform |

44.00 |

|

BofA |

9/2/2026 |

Underperform |

37.00 |

|

Cantor Fitzgerald |

6/2/2026 |

Overweight |

43.00 |

|

Deutsche Bank |

6/2/2026 |

Buy |

48.00 |

|

DZ Bank |

9/2/2026 |

Buy |

45.00 |

|

Jefferies |

6/2/2026 |

Buy |

52.00 |

|

Kepler Cheuvreux |

6/2/2026 |

Buy |

50.00 |

|

LBBW |

12/2/2026 |

Buy |

46.50 |

|

Metzler |

14/11/2025 |

Buy |

44.00 |

|

mwb research |

16/2/2026 |

Buy |

44.00 |

|

Oddo BHF |

3/2/2026 |

Outperform |

56.00 |

|

Quirin |

21/11/2025 |

Buy |

45.50 |

|

Redburn |

10/6/2025 |

Neutral |

34.60 |

|

UBS |

12/2/2026 |

Buy |

47.50 |

(As of 15/1/2026)

|

|

Revenue (€m)

|

EBT (€m)

|

Margin (%)

|

EPS (€)

|

|---|---|---|---|---|

| Median | 6,440.5 | 326.3 | 5.0 | 1.84 |

| Average | 6,444.9 | 325.5 | 5.1 | 1.83 |

The consensus data is based on the analysts’ estimates, forecasts, and opinions and the consensus derived therefrom does not represent estimates, forecasts, or opinions of the Bechtle AG.

The consensus is provided purely as a courtesy to Bechtle’s shareholders and other stakeholders and for information purposes only and is not intended to, nor does it, constitute investment advice or a solicitation to buy, hold or sell securities or other financial instruments of Bechtle.

|

Issuer |

Bechtle AG |

| Principal Amount | €300 million |

| Denomination | €100,000 per Bond |

| Status | unsecured, unsubordinated |

| Issue Date | 08 December 2023 |

| Maturity Date | 08 December 2030 (7 years) |

| Coupon | 2.0 per cent p.a. |

| Reference Share Price | €42.30 per share |

| Initial Conversion Premium | 30.00 per cent above the Reference Share Price |

| Initial Conversion Price | €54.99 per share |

|

ISIN

|

DE000A382293 |

For further information, please refer to following documents:

- Ad hoc announcement from 30 November 2023

- Ad hoc announcement from 01 December 2023

- Press release from 01 December 2023

Under the following link you will find information on the performance of the convertible bond: